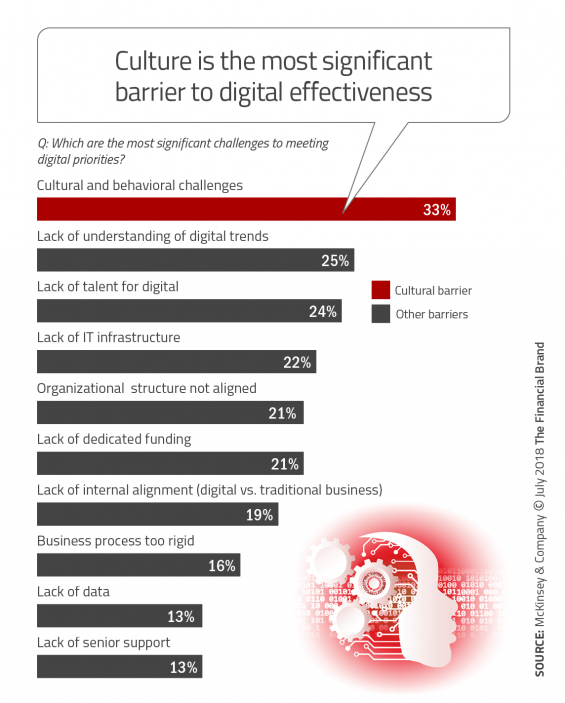

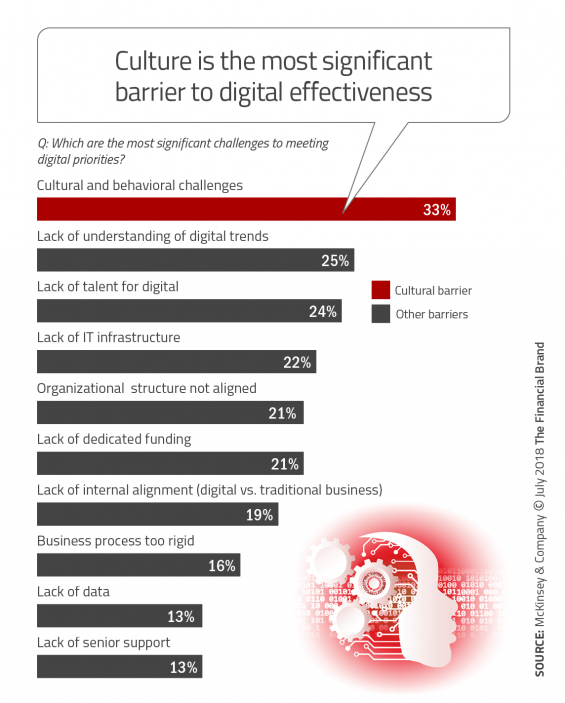

I have a problem when changing culture is the answer!

This title is enough to excite anyone one. "Digital Transformation in Banking Requires Big Cultural Shakeups" Source: The Financial Brand by Jim Marous

The core argument is that: to succeed, banks and credit unions must support the elimination of silos, be willing to embrace risk, and have an obsessive focus on the needs of the consumer.

-----

I have been saying for a while "that the next victim of digital will be the hierarchy" but I am more than every convinced that the first issue we need to address is consistency in data.

Let me explain.

Do we trust the CFO for finance. Yes we do but we verify. We get and use b/s, p/l and cash flow as tools to help backed by faith in the accounting software and access controls. We get reporting to the board in reports and use committees for SAP, remuneration and audit, then we have external audit for full verification. We had consistency in finance and this gave us a culture.

So do we trust the numbers person, yes but because we can verify.

Using the same thinking for data. [I am not taking data governance here which is a fantastic tool but is far to limited in scope] We don't have any reporting tools of the same standard. We don't have anything like we do for finance but is not our businesses equally dependent on data as finance and probably increasingly so.

In data we have no method, yet, of reporting or seeing insights/information to the board on what is going on, we have no visibility of where data is, how it got there, what consent, how our privacy terms are aligned, how our cookie policy has wider impact that a unread web site set of terms, where our data is in the supply chain or eco-system. We have no report and no verify. We have no consistency in data and this probably gives us "no defined culture". Since we treat customer data, partner data, employee data and data purchased with different attitudes, terms, systems, processes and controls - there is no one data culture. We see one finance culture.

If data is growth will a lack of consistency and the ability to manage data be the Achilles heal for banks and others?